Recent General Posts

Damaged Contents? Call Us!

9/29/2020 (Permalink)

After a tornado damaged a storage unit this customer's items were damaged. We quickly arrived to begin drying what items could be dried.

After a tornado damaged a storage unit this customer's items were damaged. We quickly arrived to begin drying what items could be dried.

Content Damage? WE CAN HELP

Wet contents are never a good thing, especially if they are soft good items because mold can grow in a hurry. The key to drying out items is being quick in approach to begin the drying services. For example if you have a lot of books or possibly clothing that was damaged by water the faster we can respond the better chance it has at drying. In the photo is an example of our team attempting to dry out items from a storage unit that had damage due to a tornado. The customer called us to come inventory the damaged items and attempt to dry and clean the other items that could be salvaged.

But How Can I Keep Track?

We at SERVPRO of Chambersburg use a special content inventory software called iCat. With iCat the homeowner is able to see a detailed list with pictures of all the items we may bring back to our facility to attempt cleaning. Another feature of iCat is it also keeps inventory of all the non-salvageable items making it easier for the homeowner to go through and make a price list to turn in to the insurance company. This really makes it nice for the customer and the insurance company when it comes to attempting to get pricing for items that are damaged.

What If Something Is Not Damaged But I Don't Want it?

That is fine! We at SERVPRO of Chambersburg can dispose of your items. You will be asked to sign an approval to dispose of items form. If something is not damage we can not place the item on the non-salvageable list but we can dispose of it for you.

What If There Is Mold Damage On My Items?

Depending on the type of material your item is the really what decides if it will be savable or not. Most solid wood furniture can be sanded and refinished in order to return the item to preloss condition. If items are made of paper, particle board, cardboard or really anything that can not be submerged into water than we recommend those moldy items to be placed on the non-salvageable list.

What Is The Non-Salvageable List?

The non-salvageable list will be the inventory of any items that we feel can not be returned to preloss condition and need to be replaced. The non-salvageable list will be emailed to you and your adjuster if applicable at the end. Once you receive the non-salvageable list you are able to get prices for the items that need to be replaced.

What Causes Items To Be Put On Non-Salvageable List?

There are many things that may occur that causes damages to your contents. Whether it is water, sewage backup, mold, or fire and soot. When an item can not be cleaned to preloss condition or is damaged beyond repairable that item will be placed on the non-salvageable list.

If you are in a situation where you need contents cleaned or even just inventoried for insurance purposes give us a call at our office at 717-261-0310 and we can put together a game plan for you!

New homeowner or first time owner what you need to know?

3/12/2019 (Permalink)

Today's learning about new homeowner insurance.

Today's learning about new homeowner insurance.

New homeowner or first time owner what you need to know?

You’ve recently purchased a home and want to ensure your investment is protected. Reviewing your insurance policy is the first step.

Question to ask your insurance provider.

- Policy Limit – You need enough cover to not only repair your homes value but to demo possible during a claim. So, if you purchased your home valued at $180,000 means you need $180,000 + value of demoing the building. In a fire you may have sustain so much damage you need to remove the structure and start over, that price will exceed your purchase price.

- Content Limit – If you had to clean or replace all the items in your home what value is that? Furniture, decoration, clothing, food, appliances etc. Most insurance carries will have a formula to estimate the value based on your homes value.

- Itemize - Your specialty antique items, jewelry, and guns normally need to be itemized on your policy to ensure the replacement cost is adequate. Some policy standardly only come with $2,000 in guns and ammunition coverage.

2018 Recap of the year of SERVPRO

1/2/2019 (Permalink)

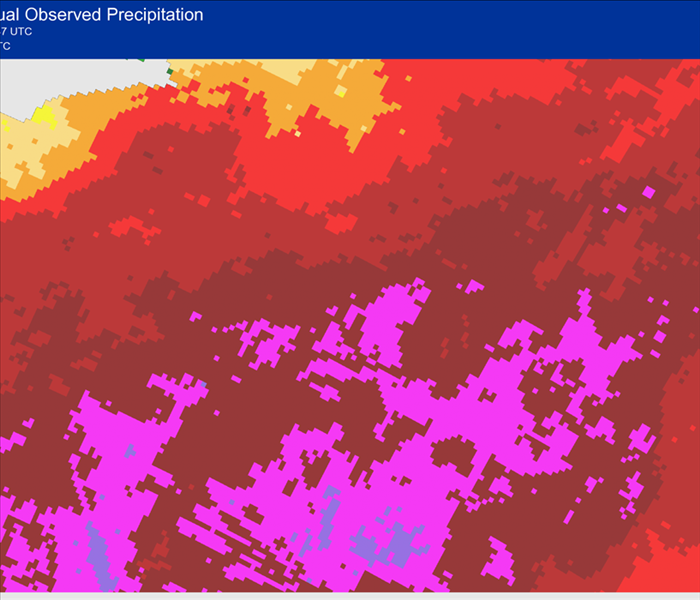

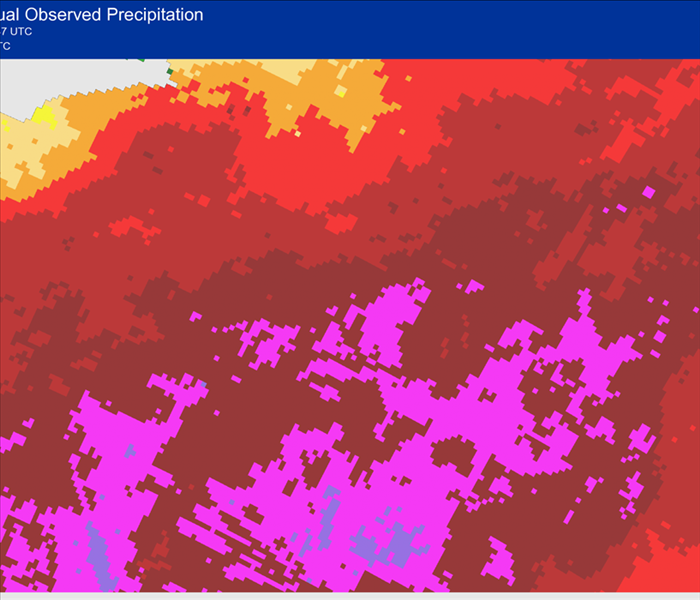

https://water.weather.gov/precip/

https://water.weather.gov/precip/

It's a new year so let's look back at 2018 and see what it looked like for SERVPRO of Chambersburg. If one thing stands out overall from this year it is RAIN. We experience a large amount of rain over and over again. April showers we expect every year but we were inundated with high volume call in Franklin County PA in April, June-August. According to the national weather services (https://water.weather.gov/precip/ ) we had approximately 20 inches then our normal for the south central Pennsylvania area.

What kind of services calls were there? Sub pump failure was the biggest issued homeowners were faced with. Either their pump wasn't able to keep up with the rate of rain they were getting or they simply stopped working. Then as homeowners were attempting to fix their pumps they were learning how the big box stores like Lowes, Home Depot were all sold out.

Once the pump was up and working again the water in their basement was able to drain most of it then SERVPRO can in with the extractor and removed the remaining water then dried out the basement with air mover and dehumidifiers.

Understand our terms and lingo.

1/2/2019 (Permalink)

Terms used in the Insurance Industry by restoration professionals.

Terms used in the Insurance Industry by restoration professionals.

SERVPRO of Chambersburg is always "Here to Help". We know that jargon can be confusing so we usually try to break it down as easy as we can out in the field, but we know that our customers like to stay informed. Here are some common terms used in the field with their definition so you can understand better what is happening in your home or business.

Anti-Microbials: A substance, mechanism, or condition that inhibits the growth or existence of an organism.Commonly applied after a water damage to prevent mold from developing.

Fire Damage Recovery: The process of restoring and recovering property and belongings after a fire. The objectives include minimizing existing damage, damage mitigation, structure stabilization, soot & odor removal and reconstruction.

Fungi: The unicellular or multicellular eukaryotic/ DNA organisms embracing a large group of microflora including: molds, mildews, yeasts, mushrooms, rusts and smuts.

HVAC: Heating, ventilation and air conditioning.

HEPA Filter: High efficiency particulate air filter, a specialized filter capable of removing 99.7% of particles. Commonly used in mold or odor job sites. HEPA Vacuum or HEPA air scrubber.

Masking Agents: Designed to prevent or remove heightened awareness to odors by providing a fragrance, which is stronger and more pleasant to smell while the source of the odor is being eliminated.

Smoke Damage Removal: Neutralizing or removing smoke odors that linger after fires.

Smoke Particles: Smoke is composed of gases / sometimes aerosols, and airborne solids. Dry wood, natural fibers and paper all produce small non-smearing material. Plastic, foam, and rubber (polymers) produce large easily smeared residues.

SERVPRO Named to Entrepreneur's Top 10 Franchise List for 7th Consecutive Year

10/24/2016 (Permalink)

SERVPRO, a cleanup and restoration franchise company, maintains its hold on the top ranking in the Restoration Services industry for the 13th consecutive year and moves up to the number four spot overall in the 2016 Franchise 500 rankings from Entrepreneur magazine. This is the seventh consecutive year SERVPRO has been included in the magazine's Top 10 list, standing out in a group of more than 951 franchises that qualified for inclusion in the list.

Entrepreneur magazine's Franchise 500 selection process uses "objective, quantifiable measures of a franchise operation" to help would-be entrepreneurs identify franchise investment opportunities. Some of the most important factors considered by Entrepreneur in developing the list each year are "financial strength and stability, growth rate and size of the system."

"This recognition affirms that SERVPRO is a dynamic organization that continues to grow and strives to always provide superior support for its franchisees, and by extension its customers," said Sue Steen, SERVPRO Industries, Inc., chief executive officer. "The recognition that the company earns year after year in this prestigious list is confirmation of a commitment to excellence that starts at the top and is evident in the service that each franchisee provides to each and every customer."

According to Steen, a number of differentiators set SERVPRO apart from the competition and fuel the attractiveness of the company to both existing franchisees and would-be entrepreneurs looking for a strong business opportunity. Key among these are:

- SERVPRO's strength as a brand with a national footprint, wide-spread market penetration, laser-focused brand messaging, and the ability to create national partnerships with organizations such as the PGA TOUR and the American Red Cross.

- SERVPRO's commitment to being a learning organization, which keeps training and support at the forefront of the company's culture and philosophy of success and helps franchisees plan, track, and deliver best-in-class services to consumers.

- SERVPRO's focus on continued development and support for proprietary software and systems to allow the company's operational capacity to keep pace with an aggressive growth strategy.

Steen adds, "One of the potential pitfalls of growing too quickly is outpacing your capacity to train and support the franchisees. SERVPRO is a conservative company, and early on we took the time to build a strong system and put the building blocks in place to support growth without sacrificing support to our franchisees." "Today," Steen continues, "as a mature franchise organization with more than 1,700 locations under a single brand, recognition like this makes it clear we are reaping the rewards of having laid a solid foundation and a framework to handle quick growth. As our brand continues to grow, we will continue our winning strategy of supporting and improving upon our infrastructure and investing resources in training and support."

SERVPRO specializes in fire and water cleanup and restoration services, helping both commercial and residential customers recover from property damage emergencies "Like it never even happened." For more fire prevention tips and information about fire and water damage restoration services, please visit www.SERVPRO.com/.

Tips for Preventing Mud from Tracking Inside Your Home

9/29/2016 (Permalink)

It’s hurricane season, which means mud and dirty everywhere. When it comes to wet weather, you’re going to want to take extra precautions to ensure that your home stays clean and tidy. Here are a few tips for making sure the mud stays outside where it belongs.

Designate a “Mud Room” Entrance

The most obvious thing you can do to prevent mud from tracking into your home is to set designated entrances for muddy feet and paws. Consider the high traffic areas in your home and remove any carpet or furniture from that area that could fall victim to muddy children or dogs. You’ll also want to set up an area for people to clean off with fresh towels and leave their shoes and boots. And don’t underestimate the power of doormats! They can do a lot to reduce dirt from trafficking into your home.

Keep Mud Off Your Floors

It’s a good idea to teach children and dogs early that the door rug is for wiping off feet and paws. A simple boot tray or shoe rack is also an inexpensive solution to muddy shoes and boots. If you don’t have a “no shoe” policy, now might be the time to institute one. Provide guests and family members with slippers to make the transition easy.

Maintain Your Mats

Don’t neglect your doormats either. All you have to do is take them out occasionally for a good shake to get out the dirt and dust. An occasional vacuuming is also a good idea. When mats get really grimy, give them a quick scrubbing with some soapy water, rinse, and air dry. Maintaining your mats will prevent people from picking up more dirt as they enter your home.

Install Gutters and Ground Covers Near Entrances

Ground cover plants can stop mud from trafficking into your home by limiting the amount of bare patches of dirt in your yard. Installing gutters near doorways will also divert roof runoff from pooling outside your entrances. Gutters are an easy way to make sure your guests don’t have to walk through a waterfall to get to your front door.

Two easy maintenance tips to prepare for Fall!

9/16/2016 (Permalink)

As much fun as summer can be, it has to end at some point. As the trees begin to change and the weather shifts from hot and humid to cool and crisp, it’s time to prepare for the onset of cooler months. Whether you’re ready for hot cocoa and sweaters or are still holding on to ice cream and swim suits, there’s a lot to do to get ready for the changing seasons.

- Inspect your roof

If you have a heavy rainstorm or a foot of snow, does your roof have what it takes to hold up? Before settling in for another chilly fall and a freezing winter take a look at your roof for weak spots or cracks in your shingles and granules. If you see anything that looks off or unstable, a roofer may be what your home needs to weather this winter’s storms. - Clean out your gutters

As the leaves begin to turn, you know you’re only weeks away from them falling off entirely and stopping up your gutters. Before you find yourself with a big mess on your hands, take the time now to clean out your gutters and drainpipes to prevent the possibility of water damage and clogs. A clean early in the season may not be sufficient through the winter, but it will make sure you’re prepared for the harsher weather to come. Water damages can be caused by clogged drains or overflowing water to collect on your roof.

Preparing your house for fall may not be what you planned to do during your weekend, but it’s something you’ll thank yourself for later. With the right measures taken now, you and your family will be prepared to settle in for the fall and winter, no matter what may be coming your way!

National Preparedness Month

9/13/2016 (Permalink)

During an emergency, the last thing you should worry about is what to do next. Every second matters during an unexpected, emergency situation which is why this year’s National Preparedness Month theme is, “Don’t Wait, Communicate!”

SERVPRO of Chambersburg would like to encourage everyone in our community to develop a game plan! Residential or commercial? It doesn’t matter! Everyone should master a set of steps to perform during an emergency and answer important questions ahead of time such as; Who will be in charge of contacting 911? Who will gather everyone to a safe location? What is the best escape method in an emergency? Etc. These questions are imperative to the safety and well being of our co-workers or families.

Everyone’s focus this month should be towards developing a disaster plan or what we at SERVPRO like to call an ERP (Emergency Communication Plan). In line with the “Don’t Wait, Communicate!” theme of this year’s National Preparedness Month, SERVPRO of Chambersburg would like to suggest developing an Emergency Communication Plan for your home or business. Several steps, listed below, can help get you started on this plan:

- Collect all of your important contact information such as; family doctor, medical facilities, local family members, schools and service providers. Compile all of this information into one, hard-copy, easily accessible sheet. *Waterproof the sheet if possible!*

- Share copies of this sheet with everyone within the household/business.

- Develop a fire/emergency escape plan that includes the safest escape routes, layout of home or business, safe meeting place and what to do if contact is lost.

- On a monthly basis review/practice all of the important contact information and emergency escape plan.

As always, SERVPRO is #heretohelp in any emergency or disaster situation. Although September is coming to an end it is never too late to be prepared! We encourage everyone to call us today to learn more about National Preparedness Month or about our free Emergency Ready Profiles!

Are you covered by your Insurance?

5/18/2016 (Permalink)

This is a question everyone should ask them self, Do I understand my homeowner’s insurance?

This article is from Fox Business

"Insurance requires you to think about bad occurrences … medical problems, car accidents, emergency home repairs. But although it may sound pessimistic to dwell on what could happen (carpe diem, anyone?), it’s important to protect yourself from some of life’s biggest surprises When it comes to protecting your home, it’s not just about safeguarding against structural damage or theft—it’s just as much about feeling secure in where you live. If disaster strikes, your focus should be on reclaiming your sense of stability. The last thing you should worry about is money.

1. What It Covers

A typical policy will pay for damage to your property and your possessions in the event of certain storms, fire, theft or vandalism. Like renter’s insurance, it also provides liability coverage if someone gets hurt on your property and decides to sue. Homeowner’s insurance also covers shelter costs, so you don’t have to face crazy hotel bills if you’re temporarily displaced from your house.

Homeowner’s insurance can protect belongings outside the home, too. If something is stolen from your car, auto insurance won’t cover it—but your homeowner’s policy likely will. “Most policies will cover your belongings when they are traveling with you,” Derrick says. “If you have a $1,200 laptop and it gets lost by the airline, call your insurance agent—right after you file the claim with the airline, of course.”

2. What It Doesn’t Cover

A standard policy has exclusions, including earth movements (landslides, earthquakes, sinkholes), power failure, war, nuclear hazard, government action, faulty zoning, bad repair or workmanship, defective maintenance and flooding. Windstorms are typically covered, including tornadoes, although insurance companies exclude tornadoes or hurricanes in some high-risk areas.

Water damage is tricky. As a rule of thumb, water from above (rainwater or a burst pipe in an upstairs apartment) is usually covered, but water from below (backed-up sewers or ground flooding) generally isn’t. If your region is prone to floods and earthquakes, you should consider supplemental coverage.

3. Why You Should Shop Around

Before committing to a policy, take the time to research an agent whom you trust—preferably one with good reviews online or via a personal recommendation.

Bottom line? Don’t just shop for a policy. Make sure you also select the best agent.

4. Which Preventive Actions Can Reduce Premiums

It may sound like common sense to have a working smoke detector, but did you know that it might also help you land a lower insurance quote? The same goes for a burglar alarm. According to insuranceagents.com, you can reduce your premium by about 5% if you install something as a simple as a deadbolt, and up 15-20% for a burglar alarm system.

Insurance companies price your premium based on how much risk they foresee, so you can reduce the premium by reducing your liability risk, thanks to some smart preventive measures. For example, if you have a pool, you may be able to reduce the likelihood of a claim—and thus, possibly lower your premium—by installing a fence and a pool cover to minimize the risk of a neighborhood kid wandering onto your property and falling in.

5. How Replacement Coverage Differs From Market Value

There are two key distinctions that every homeowner should know: “replacement cost” versus “market value.” Replacement cost covers repairing or replacing your entire home. Market value is how much someone would pay to buy your home and accompanying land in its current downtrodden condition.

When you’re considering the type of coverage to take out, a policy that’s based on market value is typically less expensive but, as State Farm puts it, “for a cash-strapped homeowner, buying a policy based on market value offers the best chance to recoup at least partial expenses after a loss.” In other words, you won’t recoup as much in the event of a serious disaster.

For those who have a good emergency fund in place, Derrick says that there is a way to possibly get more substantial coverage and still pay lower premiums: “You might consider getting a policy that covers more in terms of replacing or rebuilding your property, but with a higher deductible.”

6. Why You Shouldn’t Wait to File a Claim

When buying a policy, make sure to ask about time limits to report a claim, and then abide by them! If you wait too long, you may not be eligible for benefits—especially if waiting has made the problem worse. David Baxter works for a residential and commercial restoration company in Florida, and he remembers a customer with water damage who waited almost a month to do anything about it. “When the mold set in, and he decided to call, his insurance didn’t cover him because it was outside of the 14-day window required for reporting the problem,” Baxter says.

7. Why You Should Write Everything Down

“Homeowners must document everything that occurs during a loss, do as much as possible to mitigate [the loss]—and document such mitigation,” Garcia says.

In addition to saving receipts, contracts and appraisals, document phone calls by writing down who you spoke to and when. And be sure to stow it in a secure place! Don’t want to invest in a safe? Consider keeping digital copies online using a program like Dropbox.

8. How Jewelry Is Covered

When David Cohen lost his wife’s rings, he was relieved that his homeowner’s policy covered jewelry—but it was only up to a maximum of $3,000. “My wife gave me her rings to hold,” he says. “So I promptly put them in my jacket pocket … and then forgot about the rings when I took the jacket to the cleaners. As you can imagine, they were gone.”

Within three weeks, the Cohens received a check from their insurance company, but they were still out a good deal of money because his wife’s engagement ring was worth $6,000 alone. The lesson? When signing up for homeowner’s insurance, note the limits on jewelry. “Most people don’t realize that things like wedding rings aren’t usually covered by the basic limits in their policies,” Derrick says. “You can get an appraisal at your jeweler, and then consider buying a supplemental policy to cover it.”

9. Why Good Maintenance Matters

Insurance companies would rather pay as little as possible to repair damage, so they prize early detection and prevention. Deacon Hayes and his wife paid for a routine checkup on their air conditioner because they live in Arizona and wanted to make sure that the system was ready for summer. “The specialist told us that the unit was on its last legs because of a hail storm,” Hayes recalls. Thanks to his diligence, Hayes’s insurance policy ended up paying for a new $4,000 A/C unit.

According to Derrick, one very important thing to keep an eye on is your water bill. “If you notice an unusual spike or trend upward (and it’s not just because it’s 100 degrees outside, and you’re watering your lawn more), you could have a leak somewhere,” she says. “Finding the source early could save you from dealing with a bigger headache when a major pipe bursts.”

10. How to Save by Bundling

One way to save money is to bundle your homeowner’s insurance with other policies that you already own. “But don’t just buy a bunch of policies in order to ‘save’ money,” Derrick cautions. “For example, it makes a lot of sense to have your car and homeowner’s policies with the same company because you’ll usually get some kind of discount. However, if you don’t have a need for life insurance, don’t buy a policy just because the agent says you’ll save money on other policies.” After all, if you’re spending money on something that you don’t need, where are the savings?

http://www.foxbusiness.com/features/2013/08/14/11-tips-every-home-owner-needs-to-know-about-insurance.html

When It Comes to Home Maintenance Do You Fix It or Risk It?

5/18/2016 (Permalink)

Home Maintenance?

Home Maintenance?

This article could be an eye opening experence for new homeowners. The article was provide by Erie Insurance's Website.

The experts at HouseLogic.com say homeowners should set aside one to three percent of the purchase price of their homes (or whatever they can afford) each year for ongoing maintenance. That amounts to $2,000-$6,000 a year for a $200,000 home. However, we recently conducted an online survey through Harris Poll that found that 60 percent of American homeowners don’t have a maintenance fund. That means many homeowners could be at risk for major financial headaches down the road. For example, replacing or repairing a roof is one of the biggest expenses a homeowner may have—one that can come without warning. Nationally, the average homeowner spends about $6,600 to install a new roof, but prices can soar upwards of $20,000 depending on the size of the roof, materials used, labor costs and more.

Nearly one in four homeowners* (23 percent) admits they never inspect their roof or have it inspected unless there is a problem. Nearly a third (27 percent) of those who own a house either mistakenly believe their insurance will pay for damage that occurs to their roof over time, such as normal wear and tear, or they have no idea how their insurance works when it comes to this type of roof damage.

Homeowners also admitted to suffering some serious consequences from not maintaining their homes, with much of the damage related to water. When asked if their home was damaged due to lack of maintenance, answers included:

“Yes, did not fix a dripping leak in the upstairs bathroom, ended up leaking into first floor”

“Walls in bathroom dampened and falling apart because of leaky roof”

“Dripping water in crawl space caused mold problem”

“Water damage from improper plumbing repair”

“Flooding in the basement due to sump pump malfunction”.

Water Damage:

Clogged gutters can cause water to flow down the sides of the home and pool around its foundation, often leading to some major issues like uneven floors, cracks in walls and interior water damage. This type of claim, also known as seepage, is a maintenance issue and often is not covered under your home insurance policy. Home Advisor says homeowners can expect to pay around $3,830, on average, to repair foundation issues.

House Fires:

Laundry is part of life’s weekly grind. But did you know that dryers cause roughly 15,500 home structure fires, 29 deaths, 400 injuries and $192 million in direct property loss each year? The most common cause of dryer fires is failure to do a thorough cleaning. Because a lint trap is not a foolproof method for catching all the fuzzy stuff from clothes, lint can gradually build up and catch fire in the heating element or exhaust duct.

Water Damage:

Sump pumps are used to remove excess water from homes that would otherwise cause property damage. One survey respondent experienced flooding in his basement due to a sump pump malfunction, specifically. Water damage due to sewage and drain backups generally requires additional insurance coverage beyond a standard policy. Without that coverage, it could end up costing you, on average, $2,156, according to Home Advisor.

- See more at: https://www.erieinsurance.com/Blog/2016/Home-Maintenance-Survey#sthash.F9bCeW1A.dpuf

Vacation Planning? Prepare your home!

4/6/2016 (Permalink)

Going on vacation should be relaxing and worry-free which is why it is important to make sure your house is secure before you leave for your trip. Be SERVPRO ready so you don’t come back to damages in your home. Here are some tips for preparing your home provided by SERVPRO of Chambersburg

Make Arrangements with an Emergency Contact

Choose a close friend or neighbor you trust as your emergency contact and provide them with all of your itinerary information in case they need to contact you.A timer on lights will give the impression someone is home.Leave written directions for alarm codes, doors, or other information needed to properly care for your home.Make sure your mail is collected; burglars often look for homes with overflowing mail. The Post office can suspend your mail and deliver the day you get back. Here is a link to the US Post Office

Take plumbing and electric precautions

Prevent leaks and floods from damaging your home by shutting off gas and water at the meter, supply tank or appliances.Turn off the water valves to washing machines, sinks, and the dishwasher.Unplug electronics to cut down on any possible shortages which could potentially cause a disastrous fire.Check your smoke detectors to ensure they are working properly.Adjust your thermostat for the season in the winter 55-60 in the summer 75-80 should help control usage. Right before you leave

Notify your security company that you are leaving town.Take out the kitchen trash and other trash that could get smelly.Go on one last walk through of your home to secure windows, blinds, fences, doors, and plugs. This will ensure all entries are safe from hazardous obstructions. If you come back from vacation and encounter damage within your home, call SERVPRO of Chambersburg 717-261-0310. We clean up mold, fire or water damage to your home or business in the Chambersburg and surrounding areas.

Emergency Planning

4/6/2016 (Permalink)

Even with insurance coverage, disasters can shake the foundations of even the best-managed companies. Make abusiness assessment for the survival of your company. Regardless of the cause of the catastrophe, a company’s very survival often depends on being prepared to responding quickly and efficiently, so a carefully constructed disaster recovery plan is one asset that every business needs. Before any calamity strikes, you should know what tasks will need to be performed to get your company running again and who will be responsible for accomplishing them. While there is no one-size-fits-all recovery plan, every business’ strategy should include some basics. Laying the groundwork by preparing to handle insurance claims, scouting viable options for temporary operations and considering the implications of various financial alternatives before trouble strikes can make the process of recovery much easier. The impacts from hazards can be reduced by investing in mitigation. If there is a potential for significant impacts, then creating a mitigation strategy should be a high priority.

https://www.ready.gov/sites/default/files/5.2.1.0%20Risk%20Assessment%20Process.png

Insurance Considerations

Depending upon the details of the policy that you have selected for your business, commercial property insurance may cover damage or loss of the insured property, time element losses, loss mitigation costs, and loss adjustment expenses. It may also cover costs for public relations, research and development, and other necessities. When a disaster occurs, it is crucial to take the steps that will preserve and maximize your insurance coverage. To ensure that you receive all the benefits that your business is entitled to, familiarize yourself with the ins and outs of your policy before any problems arise. Work with your insurance company to create a checklist of your responsibilities after a loss to aid you in meeting deadlines and assembling documentation. Knowing what you are responsible for and being organized will make the recovery smoother and faster.

Making Your Claim

If your business is hit by disaster, set your recovery plan into motion by providing prompt notification of any claim to your insurance company. Be ready to meet any deadlines for filing proof of loss statements. If circumstances make the deadline for these statements unreasonable, get written approval for extensions. Be prepared to meet any requirements for preserving the evidence of your claim if destructive testing or immediate remediation is necessary. You will also want to record your loss mitigation efforts and the reasons that these efforts were needed.

Regardless of the cause of the catastrophe, a company's very survival often depends on responding quickly and efficiently, so a carefully constructed disaster recovery plan is one asset that every business needs.

Regardless of the cause of the catastrophe, a company’s very survival often depends on responding quickly and efficiently, so a carefully constructed disaster recovery plan is one asset that every business needs. SERVPRO of Chambersburg has a FREE customizable app that can aid your company recover in a timely manner.

Timing Matters

Timing is critical in insurance claims. While keeping your insurance company informed is important, you need to understand any time limitations in your policy and their potential consequences. Review your policy to see if there is a deadline for electing a valuation method. See if there is a time limit for rebuilding or replacement. You will also want to check your policy for a suit limitation clause. Most policies contain one, so you will want to be sure that it is conservatively calendared to give you time to maneuver if necessary.

Payment Possibilities

It is not surprising that cash flow is a primary concern for a business working to recover after a catastrophe. While it can take time for a claim to be settled, some insurance policies contain provisions for claim advances or partial payments. Search through your policy to see if these provisions are included and identify how you would invoke them.

Re-establishing Operations

A business impact analysis (https://www.ready.gov/business-impact-analysis) of your business before a disaster will plan and effectively get your business running smoothly again. Before anything bad happens, think about how your business could operate during the recovery phase. This may involve moving to a temporary location or finding storage for undamaged inventory or equipment, so it’s smart to be aware of the possibilities in your area. Make a note to analyze leasing and service contracts if you are forced to relocate so that you can try to tailor them to your business’s specific needs.

Property Considerations

Regardless of where you set up shop after a catastrophe, you will have to decide what to do with your original location. Is rehabilitating or rebuilding the site worthwhile? If you believe that it is, then you will need to arrange for professional remediation, design and construction services. If you decide against rebuilding, then you must figure out how to dispose of that property and acquire a new permanent location. Remember that a new location will still require design and construction services in order to modify it to suit your company’s needs. Don’t forget to review zoning issues for any new property to verify that your business will be able to build appropriate facilities and operate as desired at that location.

Financing Issues

Even with insurance, a recovery may require financing. Depending on your recovery plans, options might include a line of credit, an acquisition loan or a construction loan. In some situations, it may be possible to use legal actions to seek reimbursement from the party responsible for your loss. Weigh all the possibilities carefully and remember to consider the potential tax consequences. Understanding the pros and cons of your options before any problems start will make it easier to make smart decisions when a disaster hits

When your business needs assistance dealing with the aftermath of a catastrophe, count on SERVPRO of Chambersburg. Our professionals are prepared to respond, so when a significant event occurs, they’ll be there for you. Whether it is damage from flooding, a fire, a tornado, a hurricane, an ice event or a snowstorm, we have the resources and expertise to help .

Insurance coverage myths

12/21/2015 (Permalink)

This article originally appeared on Insure.com.

Something about insurance are known to be true. Customers pay a premium, sometimes have to pay a set deductible, and the insurer pays out in certain situations. But there are plenty of myths out there surrounding the insurance business.When shopping for a policy, however, those misunderstandings can be costly for clients.

In an effort to better understand the misconceptions that surround the insurance industry, Insure.com recently surveyed 2,000 U.S. adults and asked them whether a series of 10 insurance statements were true or false. They also calculated whether men or women believed each myth more often.

Read on to see what they found...

Myth 1: "I should buy insurance coverage for my house based on its real estate market value"

· 52% think it’s true (among those who said it's true, 45% were women, 55% were men).

· Tip: Buy coverage based on the costs to reconstruct the home. Imagine your home being leveled by fire or a tornado – this is a worst-case scenario that you want to insure for. In many areas of the country, rebuilding costs are quite different from real estate market value. In areas with a weak housing market, it might cost more to rebuild your house than what you could sell it for. And don’t include the value of the land in your coverage amount. An insurance agent can help calculate rebuilding costs.

Myth 2: "Red cars cost more to insure"

· 46% think its true (52% women, 48% men).

· Tip: Car color doesn’t affect insurance rates and insurance companies don’t use it in their calculation of rates.

Myth 3: "If I cause a crash with extensive damage to others, my auto insurance company can cancel me immediately"

· 44% think its true (50% women, 50% men).

· Tip: Most states have laws that prohibit insurers from canceling you mid-term due to a claim. If the insurer doesn’t want your business, they generally have to wait until your policy period is up and then they can send you a notice of nonrenewal. However, you can be canceled at any time for not paying your premiums.

Myth 4: "Small cars are the cheapest to insure"

· 40% think its true (42% women, 58% men

· Tip: Small and mid-size SUVs and minivans are the cheapest to insure. In the 2014 model year, the Jeep Wrangler Sport is the least expensive vehicle to insure, according to Insure.com’s study of rates. Small cars do not have the cheapest rates because they are often chosen by younger, inexperienced drivers who submit more claims. Also, injury claims are higher from small cars, which lack the weight and protection offered by larger vehicles.

Myth 5: "The Affordable Care Act (also called Obamacare) allows health insurance companies to base rates on medical conditions such as high blood pressure, heart disease and cancer"

· 36% think its true (42% women, 58% men).

· Tip: The Affordable Care Act prohibits health insurance companies from basing rates on pre-existing conditions. Nor can health insurers charge different amounts for men and women.

Myth 6: "Comprehensive auto insurance covers everything and anything"

•32% think its true (41% women, 59% men).

•Tip: If we could go back in time, we should never name it “comprehensive coverage.” Even “non-accident specific-problem coverage” would be less confusing to car insurance buyers. Comprehensive coverage pays for certain problems such as car theft, storm damage, animal collisions and vandalism.

Myth 7: "Thieves prefer to steal new cars"

•29% think its true (42% women, 58% men).

•Tip: Older cars are more valued among thieves because the market for their parts is bigger. If you want to cover car theft, buy comprehensive coverage.

Myth 8: "If my friend borrows my car and crashes it, their insurance will pay for damage"

•25% think its true (48% women, 52% men).

•Tip: Handing your car keys to a friend or relative is like handing them your insurance future. If they cause damage, the claim goes on your auto insurance policy and can affect your rates for years to come. And they probably won’t offer to chip in.

Myth 9: "The Affordable Care Act requires me to take the health insurance plan offered by my employer"

•19% think its true (41% women, 59% men).

•Tip: The Affordable Care Act requires almost all Americans to buy a health plan but doesn’t say where you must get it. If you don’t have access to health insurance through work or a spouse’s employer, mark your calendar for the open enrollment period for 2015 individual health insurance, which starts on Nov. 15, 2014.

Myth 10: "Out-of-state speeding tickets can't follow you home"

•13% think its true (34% women, 66% men).

•Tip: Those tickets can follow you, and can affect your car insurance rates. This myth had the biggest disparity between men and women among the survey questions, with far more men believing they could get away with speeding in another state.

Meet Brittany Snyder, GM for SERVPRO of Chambersburg

9/24/2015 (Permalink)

General Manager, Brittany Snyder

General Manager, Brittany Snyder

Brittany is the General Manager for SERVPRO of Chambersburg. She joined the franchise in May of 2011. During her time with SERVPRO, she has learn all function of the company. Her main focus at SERVPRO of Chambersburg is building community relationships and customer satisfaction and devolving a strong team to service the customers.

Brittany also serves on several community committees: Chambersburg Chamber Ambassador, United Way of Franklin County event planning, Chambersburg Chamber Referral Group, Crab Feast Committee and a few more. Brittany is also a certified continuing education instructor for insurance.

Specialty Cleanup: Hoarders, Elderly downsizing.

6/30/2015 (Permalink)

Lease Agreement

Lease Agreement

Did your tenants leave behind a mess when they moved out?

SERVPRO of Chambersburg is able to provide a wide verity of services. When the job gets to tough for the average cleaner and requires some special skill, SERVPRO is there to help get the job done.

Weather it's a hoarders home, elderly who are looking to downsize SERVPRO is able to apply their special skills to make a safe, clean and sanitary area for others.

SERVPRO of Chambersburg's New Addition

6/4/2013 (Permalink)

Our new addition is up and looking good. Won't be long now!!

Our new addition is up and looking good. Won't be long now!!

SERVPRO of Chambersburg's new addition is nearing completion. We broke ground on our new 3,200 square foot, three bay garage and warehouse in April of 2013. We are very excited to celebrate the completion of our garage with a Chambersburg Chamber of Commerce Ribbon Cutting Ceremony and an Open House in late July, 2013.

After a tornado damaged a storage unit this customer's items were damaged. We quickly arrived to begin drying what items could be dried.

After a tornado damaged a storage unit this customer's items were damaged. We quickly arrived to begin drying what items could be dried.

24/7 Emergency Service

24/7 Emergency Service